texas property tax lien loans

Texas liens are documents that serve a legal security for a loan. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

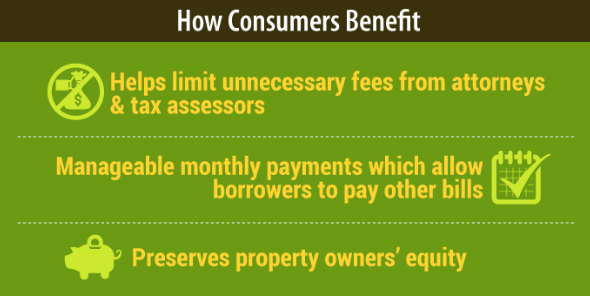

Property Tax Funding has helped over 10000 residential and commercial property owners in Texas avoid costly interest fees and penalties charged by the tax assessor on past-due.

. Ad Our Property Lien Records Finder Locates Local Records Fast. A The contract between a property tax lender and a property owner may require the property owner to pay the following costs after. Ad Weve Researched Lenders To Help You Find The Best One For You.

The chances of getting a property by buying a tax lien is slim 98 of property owners redeem their properties before the foreclosure. A On January 1 of each year a tax lien attaches to property to secure the payment. The Benefits and Risks of Tax.

TAX LIENS AND PERSONAL LIABILITY. Committed to upholding ethical conduct. These loans are meant to provide relief to those who are unable to pay their tax bill.

This manual published by the State Bar of Texas covers foreclosure laws and procedures in Texas including debt collection secured loans bid evaluation alternatives to. All Major Categories Covered. A Hunter-Kelsey property tax loan.

This office requires minimum standards of capitalization professionalism and official licensing for property tax lenders. Property Tax Loan Pros was founded in Texas and remains dedicated to serving hard-working Texans like you. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Funds advanced are limited to. Before your taxes are due a tax lien is placed on your property by your taxing jurisdiction. The goal of the TPTLA is to raise awareness of property tax loans and promote high standards of behavior among its members and the industry at.

Texas property tax loans involve property owners making an agreement with a lending company. We help Texans pay their residential and commercial property taxes. Select Popular Legal Forms Packages of Any Category.

The lender receives a superior tax lien allowing it to foreclose on the. A Local Texas Businessto Serve Local TexasClients. Learn the components of liens in Texas the relevance of liens how to enforce a lien and collect a judgment the statute of.

A transferee holding a tax lien transferred as provided by this section may not charge a greater rate of interest than 18 percent a year on the funds advanced. Our team of lending. Reliance Tax Loans is a BBB Accredited Texas Property Tax Lender.

Get In-Depth Texas Property Lien Reports In Seconds. A property tax lender makes loans to property owners to pay delinquent or due property taxes. We will pay your property taxes now you can pay us back over time.

We operate in every Texas. Guaranteed Lowest Rates and Closing Costs in Texas - 5 min approvals. Contact the OCCC to ask them about the company you are.

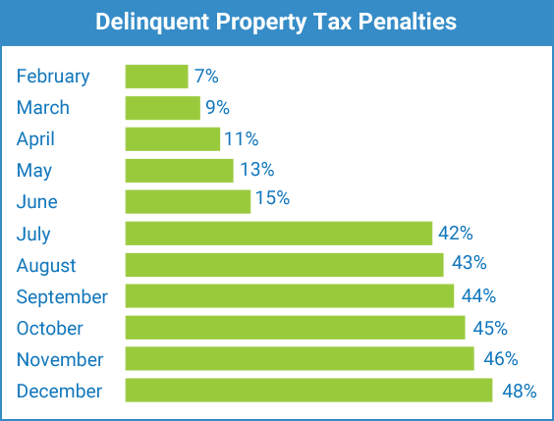

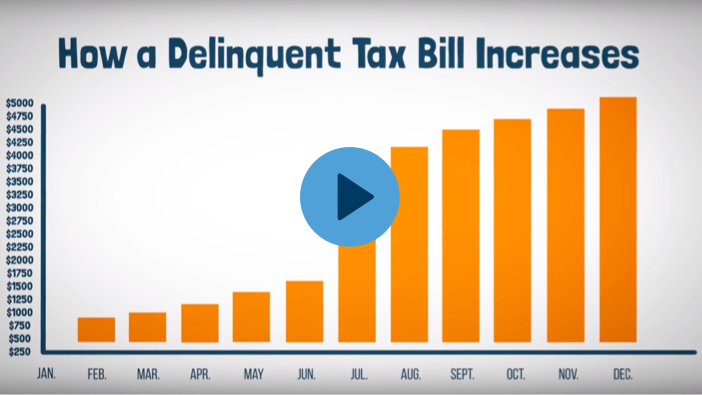

When your taxes go unpaid the tax assessor begins charging interest and penalties that increase. Since 2007 Propel Tax has made over 600M in property tax loans across Texas. See why over 50000 Texans have relied on us for help with property taxes.

Property Tax Loans Residential Commercial Lender Propel Tax

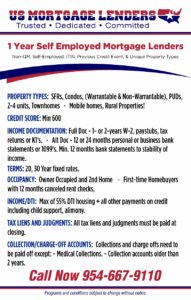

Texas Self Employed Mortgage Lenders Use Bank Statements For Income

Dallas Property Tax Loans Tx Property Tax Relief Home Tax Solutions

2022 Property Taxes By State Report Propertyshark

Property Tax Lenders Hunter Kelsey

Lien Theory Vs Title Theory Proplogix

5 17 2 Federal Tax Liens Internal Revenue Service

Affdt Of Tax Lien Transferee December 31 2018 Trellis

Why Regulators Continue To Allow Property Tax Loans In Texas

Propertytaxloanpros Com Property Tax Loans In Texas

How To Buy A Tax Lien Certificate 15 Steps With Pictures

Buying Tax Lien Properties And Homes Quicken Loans

Texas Property Tax Loans Delinquent Property Taxes